tax identity theft description quizlet

If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you must file a paper return. The IRS state tax agencies and private industry partner to detect prevent and deter tax-related identity theft and fraud.

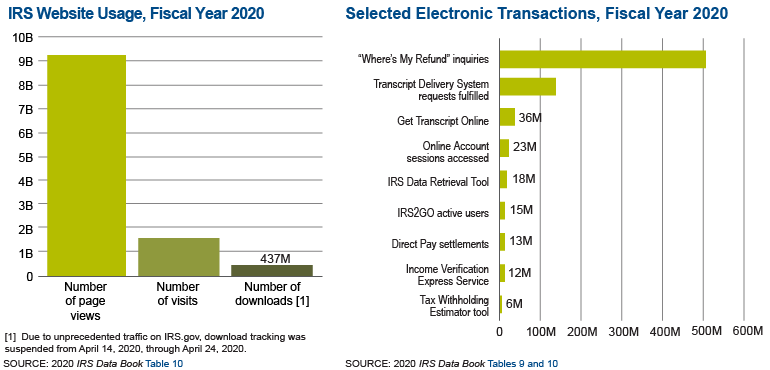

Service To Taxpayers Internal Revenue Service

They may also use your Social Security number in order to obtain employment.

. What is criminal identity theft. While using his credit card to buy drinks for a bar full of patrons Diana tangles with the bartender and ends up getting arrested giving Sandys name as her own. The IRS in partnership with the state tax administrations and the software companies that produce at-home filing software has announced several changes.

A tax ID fraudster often part of a ring of scammers will file dozens or even hundreds of phony returns with other consumers personal information on it. Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit fraud or other crimesThe term identity theft was coined in 1964. This route gives them access to much more information than just one single person making it a much larger tax-related fraud scheme.

Tax info bank or credit card statements or pre approved credit card offers. And the United States as the theft of. Remember that the IRS only initiates contact with taxpayers by mail.

In the movie Identity Thief Melissa McCarthy plays Diana a woman who steals the identity of a man named Sandy played by Jason Bateman. This includes determining if there are additional victims who may be unknown to you listed on. Tax return identity theft is the act of filing a return using a stolen identity and taking the victims refund.

This type of ID theft happens when fraudsters break into the secure systems of actual tax preparers and online tax preparing systems. Start studying Identity Theft Test. ID theft through a tax professional.

These new measures are. There are a lot of ways ones identity can be stolen. All identity theft is a crime under California law but criminal identity theft refers to one type of the crime.

Unbeknownst to you the criminals may file your taxes in order to claim your refund resulting in tax return identity theft. Criminals send these claims to the Internal Revenue Service IRS using stolen personal details such as your social security number SSN and name. Tax identity theft is a growing issue and occurs when someone uses another individuals Social Security number SSN to file a false tax return claiming a fraudulent refund.

English 3 Labo 3 Quadri 2. If tax identity theft has occurred you will likely have to refile your tax return by paper. Learn vocabulary terms and more with flashcards games and other study tools.

Tax Identity Theft This Identity Theft shows itself through fraudulent tax refund claims. The IRS doesnt initiate contact with taxpayers by email text messages or social media channels to request personal or financial information. If you receive an out-of-the-blue phone call or email from.

The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund Basically its identity. Equipped with three simple ingredients a name birthdate and Social Security number the thief can commit tax fraud resulting in delayed or stolen refunds. The fraudulent refund can be obtained via mail or direct.

-slow down tax refund-leave you with a criminal record-kill you virtually. Data Breach An incident in which sensitive protected or confidential records have potentially been viewed stolen or. A form of identity theft in which someone steals the identity and sometimes even the role within society of a recently deceased individual.

Send in all requested forms using certified mail with return receipt requested to ensure the documents are received. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. Wrongfully acquiring and using someones personal identification credit or account information.

The IDTVA organization will work to resolve your identity theft case by. During tax season tax identity theft is one of the most common forms of identity theft. LW - Corporate and Fraudulent Behaviour.

The Equifax security breach alone exposed 143 million consumers with complete data on Social Security numbers names addresses birth dates and in some cases drivers license numbers. Tax identity theft is a large-scale problem in the United States due to an increase in cyber attacks on employers insurers payroll service providers universities and retailers. Addressing all the issues related to the fraudulent return.

Since that time the definition of identity theft has been statutorily defined throughout both the UK. Criminal identity theft occurs when someone cited or arrested for a crime uses another persons name and identifying information resulting in a criminal record being created in that persons. Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in your name and collect a.

A government agency that promotes consumer protection. Start studying Identity Theft. The goal is to trick the IRS into issuing a tax refund often on an easily-cashable.

The phrase criminal identity theft may be misleading. Assessing the scope of the issues and trying to determine if your identity theft issue affects one or more tax years. When the real Sandy tries to use his.

Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return. In many cases the taxpayer may not discover the fraud until attempting to file their taxes only to find that someone else has already fraudulently filed for them and cashed their refund check. Terms in this set 28 Identiy theft.

Taking money credit card numbers personal Information from a purse or wallet records at work or school tax records bank or credit card. The scam works like this. Learn vocabulary terms and more with flashcards games and other study tools.

Estimates are that this form of fraud costs consumers 52 billion each year. Tax identity theft occurs when someone steals your Social Security number and uses it for fraudulent purposes. Phishing and Online Scams.

This is done so that the thief can claim the victims tax return for themselves. Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve. SOC 346 final study guide.

W2 W4 Form 1040 And Credit Card Terminology Flashcards Quizlet

Ethics Responsibilities In Tax Practice Flashcards Quizlet

Ethics Responsibilities In Tax Practice Flashcards Quizlet

Learn More About A Tax Deduction Vs Tax Credit H R Block

Ethics Responsibilities In Tax Practice Flashcards Quizlet

It Is Easy Today To Obtain A Store Credit Card That You Forget Everything About In 3 Years But T Credit Repair Business Credit Repair Services Improve Credit

Ethics Responsibilities In Tax Practice Flashcards Quizlet

What Is Alternative Minimum Tax H R Block

Ethics Responsibilities In Tax Practice Flashcards Quizlet

Ethics Responsibilities In Tax Practice Flashcards Quizlet

Fed Tax Outline Flashcards Quizlet

Your Guide To Prorated Taxes In A Real Estate Transaction

Ethics Responsibilities In Tax Practice Flashcards Quizlet

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)